Image

The Anoka-Hennepin School District District’s OPEB trust fund has a more than healthy balance currently, but is projected to see more modest growth going forward, the school board learned in a presentation on March 27.

The district’s Chief Financial Officer Michelle Vargas and Senior Vice President CFA Merle Waters, with Wells Fargo Bank, said with interest rates rising will lead the Wells Fargo’s irrevocable Other Post-Employment Benefits trust fund to grow at a slower rate.

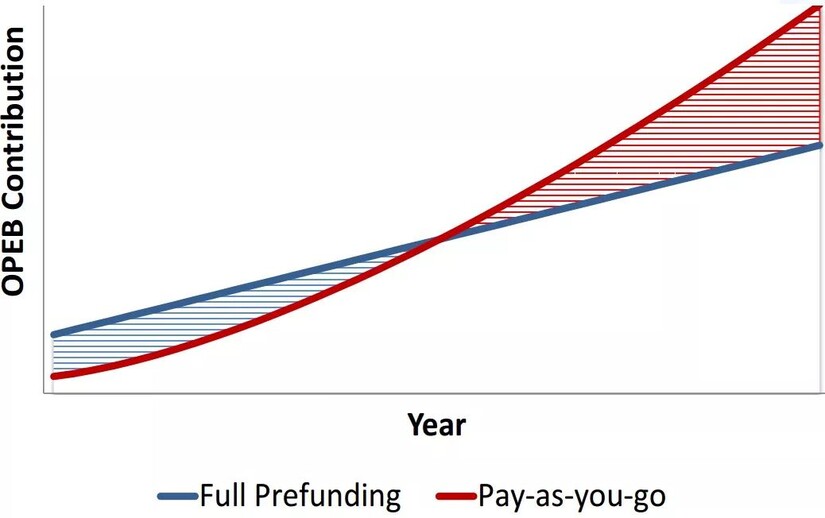

In 2009, the district issued $26 million in bonds to address OPEB liability with the money invested into a trust, Vargas said. Each year, the district pulls from the fund to pay for its OPEB obligations. Those withdrawals have ranged from $600,000 to $1.1 million.

“Annually, we draw to offset what is called the ‘implicit rate,’” Vargas said. “So our retired members who are allowed to stay on by statute on our health insurance plans, and they get the member rate and not a higher retiree rate. That difference between their premium and what they actually cost the plan is considered that implicit rate.”

Minnesota State Statute 356 A, passed in 2022, provides a legal framework of how the trust’s funds are managed.

“The biggest change that really occurred with this — in being able to do an OPEB trust — is initially you were restricted to government securities,” Waters said.

What 356 A now allows entities to do is to invest in equities, a category the state references as other investments, so the trust fund can now invest in private equity and venture capital.

“The focus there being to try to establish, or to allow for, an investment portfolio, this is really more of a pension-type obligation that you have, so it was to allow for pension-like investments to match the liability that you now have longer-term,” Waters said.

The trust’s objective is moderate growth, and that will last more than 10 years.

“Think of this really as a portfolio that will be around for decades and decades and decades in time,” Waters said.

The fund’s market value at the end of 2022 was just under $36.2 million.

Waters mentioned that this March has been volatile with two bank closures, so those 2022 numbers were now slightly outdated.

“I did look at the end of trading last Friday, the market value stands at just under $36.8 million,” Waters said on March 27. “So with everything going on this year, the portfolio’s up about $600,000 in value.”

Since inception, the trust fund has grown at an annualized rate of 4.09%. Last year, the rate of return stood at about 5.5%, Waters said. The fund’s target is about 5%.

“This was set up not to hit a home run for you, this was set up to be a relatively conservative approach to growing the portfolio so you could continue to meet your distribution requirements for a long period of time,” Waters said.

That is why about 50% of the portfolio is invested in bonds or fixed income.

Last year, not only were equities down in price, but fixed income was as well, Waters explained.

“With the Fed increasing interest rates as dramatically as they did last year, that just pushed the value of the bond portfolio down,” Waters said. “So in prior years where we had a down equity market, the fixed income piece would hold its own, or it would be up perhaps in value. That was not the case last year. So a tougher year for the portfolio.”

The fund’s bond portfolio was down by 11.16% for the year and the trust’s equity portfolio lost 18.58% for the year. The fund contains a small portion of real estate and that portion of the fund that increased by 8.92%.

“Our view going forward and the message here really is just to expect more modest rates of return,” Waters said. “When interest rates are zero, and borrowing is essentially zero, asset prices can inflate. That’s really what we had happen for a long period of time. That’s gone. We have an inflation problem now.”

With interest rates higher it’s a more challenging market for risk assets, he said.

“What does that mean for the trust?” Waters asked. “It means continue to manage it somewhat conservatively, somewhat defensively. We still want to grow it.”

With the fund’s market value at $36 million and the obligation at $29 million, “you’re still fully funded even after a 2022.”

Waters concluded with a slide of a chart showing the U.S. market’s resilience from 1965 to 2022. Even with many ups and downs, the U.S. economy continues to grow and the fund should be thought of as a 30-to-40-year investment.

“When we implemented it back in 2009, that was when we were going through extreme budget cuts and changes, and this was a way that we were able to actually generate some revenue to offset some costs that were required,” she said. “When we issued it, it was $26 million in bonds and that was based on our actuarial analysis at the time. We have $36 million in there, so we’ve been able to invest at a little riskier than we’re allowed to for everything else, but still at a conservative rate.”

When the trust was first proposed “the actuarial had us spending the $26 million in 10 years,” Vargas said. “Well, it’s been over 10 years and we’re overfunded and we’re doing well.”

SOURCE: Hometown Source