Image

Thousands of students are scrambling to finish their college applications, as many Minnesota schools have a final deadline this week.

The big picture:

College tuition has risen dramatically over the past 50 years. While prices have flattened in recent years, paying for higher education remains a major burden for many families.

Zoom in:

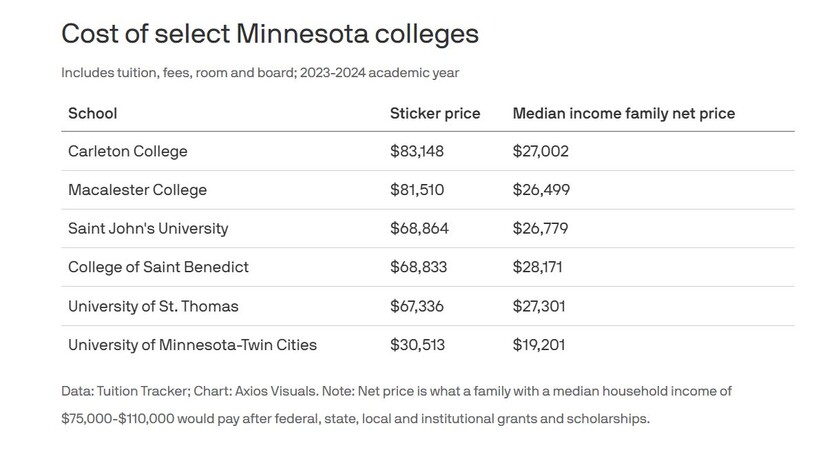

At least eight private colleges in Minnesota have sticker prices above $60,000 for the 2023-24 school year, according to Tuition Tracker, which uses U.S. Department of Education data. That figure includes tuition, fees and on-campus living costs.

Yes, but:

Only 36% of students at Carleton pay full price, according to the tracker.

Meanwhile, the University of Minnesota's cost is $30,513 a year, but the estimated net price for a median-income student is $19,201.

Of note:

University of Minnesota system schools in Duluth, Crookston and Morris will raise tuition by only 1% next school year.

With costs in mind, Axios asked Thrivent financial advisor Autumn Schinka how families can save for higher education.

What they're saying:

Start saving early, Schinka advised. Parents could start with as little as $50 or $100 a month, she said, but the key is to have the money automatically sent into a college savings account rather than putting it off and risking spending it elsewhere.

Yes, but:

Saving for college is hard for many families, especially those with their own student debt or child-care expenses.

The bottom line:

Parents should be talking to their kids about how much college costs, Schinka said.

Editor's note: This story has been corrected to show when the University of Minnesota's tuition increase took effect and that students won't face an increase next year.

SOURCE: AXIOS