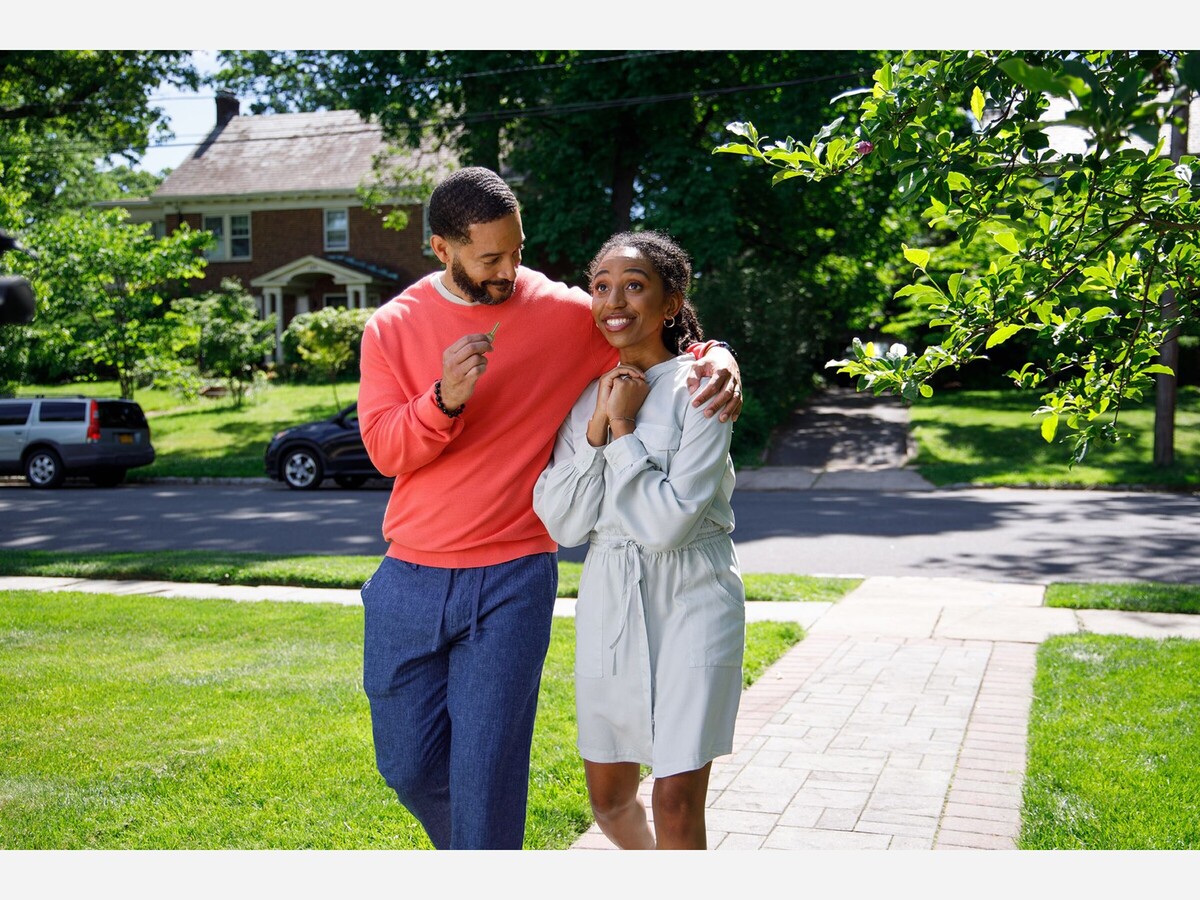

Twin Cities Residents Can Receive up to $17,500 to Purchase Home

Homeownership offers more than just security and stability – it provides a true sense of place. Yet, many prospective buyers still face significant hurdles. Unreleased data from Bank of America’s 2025 Homebuyer Insights Report reveals:

Top reasons prospective buyers hesitate to purchase a home:

High home prices (46%)

Credit score isn’t good enough or they have too much debt (33%)

High interest rates (40%), a slight improvement from 51% in 2023

Many buyers also lack confidence in key parts of the process:

41% of prospective buyers say they aren’t confident in their understanding of how to finance or secure a mortgage

53% are not confident in their understanding of how homebuying grant programs work

Grant programs can make a meaningful difference by helping eligible buyers overcome both real and perceived obstacles. For eligible buyers in the Twin Cities, Bank of America’s Community Homeownership Commitment® provides free educational resources and grant[s] that don’t need to be repaid, including:

Down Payment Grant, which offers eligible homebuyers 3% of the home purchase price, up to $10,000, whichever is less, to help with the down payment. *Only include in Markets where Down Payment Grant is available

America’s Home Grant, which offers eligible buyers up to $7,500 to be used for non-recurring closing costs, such as title insurance and recording fees, or to buy down their interest rate.

For more home buying resources, Bank of America Real Estate Center® or the Home Resource Center.