Image

ANOKA, Minn.

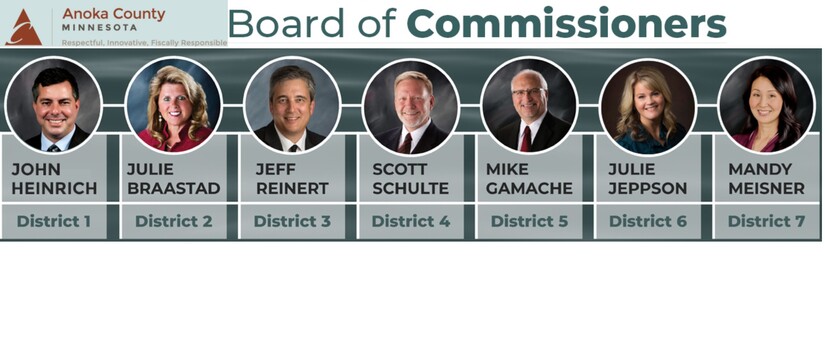

During its statutory and organizational meeting on January 6, 2026, the Anoka County Board of Commissioners approved a 3 percent salary increase for county commissioners for the 2026 calendar year, formalizing the adjustment through its annual compensation resolution for elected and non bargaining officials.

The increase was adopted as part of the board’s broader resolution establishing compensation and expense amounts for county commissioners, appointed officials, department heads, and select employee groups for 2026. Under Minnesota law, commissioner pay must be set by board resolution and cannot take effect until January 1 of the following year, a requirement that places the vote squarely within the board’s early January organizational agenda.

County materials cite Minnesota Statutes governing county compensation, including provisions that require commissioner salaries to be established publicly and paid in equal installments throughout the year. The same resolution reaffirmed existing caps on commissioners’ annual expense allowances, holding them at $7,500 per commissioner and $8,500 for the board chair, intended to cover unreimbursed county business expenses.

The 2026 adjustment follows a pattern of incremental annual increases designed to keep elected official compensation aligned with regional and internal benchmarks. In 2022, the base salary for an Anoka County commissioner stood at $75,192. With cumulative annual adjustments typically ranging between 2 and 3 percent, the approved 2026 increase places commissioner compensation closer to the mid to high $80,000 range, depending on the effect of prior year compounding.

County officials have historically framed these adjustments as part of a broader effort to maintain competitive compensation relative to peer counties in the Twin Cities metro and to mirror cost of living and merit based increases applied elsewhere in county government.

That alignment was explicit in the 2026 resolution. The same document set a merit amount of up to 3 percent for certain non union and unclassified employee groups, subject to performance and funding availability. Several collective bargaining units, including Work Release and Highway and Parks employees, are operating under agreements that reflect similar percentage adjustments for the 2026 to 2027 period. Union governed wages remain subject to separate labor contracts.

The board’s organizational actions also include setting minimum salaries for other countywide elected officials, including the sheriff and county attorney. In 2022, the Anoka County Sheriff earned $179,171, while the County Attorney earned $193,731, with both positions historically seeing percentage based increases comparable to those approved for commissioners.

The pay increase comes as Anoka County enters 2026 facing notable fiscal pressures. In December, the board finalized a 2026 property tax levy increase of approximately 9.4 percent, down from an initial proposal closer to 9.9 percent after public discussion and revisions.

The total certified levy of roughly $200.3 million funds core county services, including public safety, infrastructure, health and human services, and workforce costs. County estimates indicate the levy adjustment translates into an increase of about $84 annually for a median valued home, estimated at $338,000.

At the same time, county leadership has acknowledged a strategic shift away from relying on one time reserves to support recurring expenditures such as wages and benefits. That transition has sharpened scrutiny on compensation decisions across all levels of county government.

While the commissioner pay increase typically passes as a routine component of the annual organizational resolutions, it has unfolded against a backdrop of broader debate over the county’s long term compensation strategy.

In late 2025, the board discussed findings from the so called Helios Analysis, a comprehensive market study commissioned to evaluate county salary schedules and competitiveness. Supporters argue that aligning pay more closely with market benchmarks is essential to recruitment and retention, particularly in high demand public sector roles.

Some commissioners, including Commissioner Scott Reinert, raised caution during prior discussions, emphasizing the need to review the full fiscal picture before approving structural changes. Concerns focused not on the standard 3 percent adjustment itself, but on the cumulative impact of levy increases, wage growth, and benefit costs on taxpayers over time.

For 2026, the board moved forward with the established adjustment framework, pairing the commissioner pay increase with capped expenses and a broader compensation plan that county leaders say balances competitiveness, fiscal responsibility, and transparency.