Image

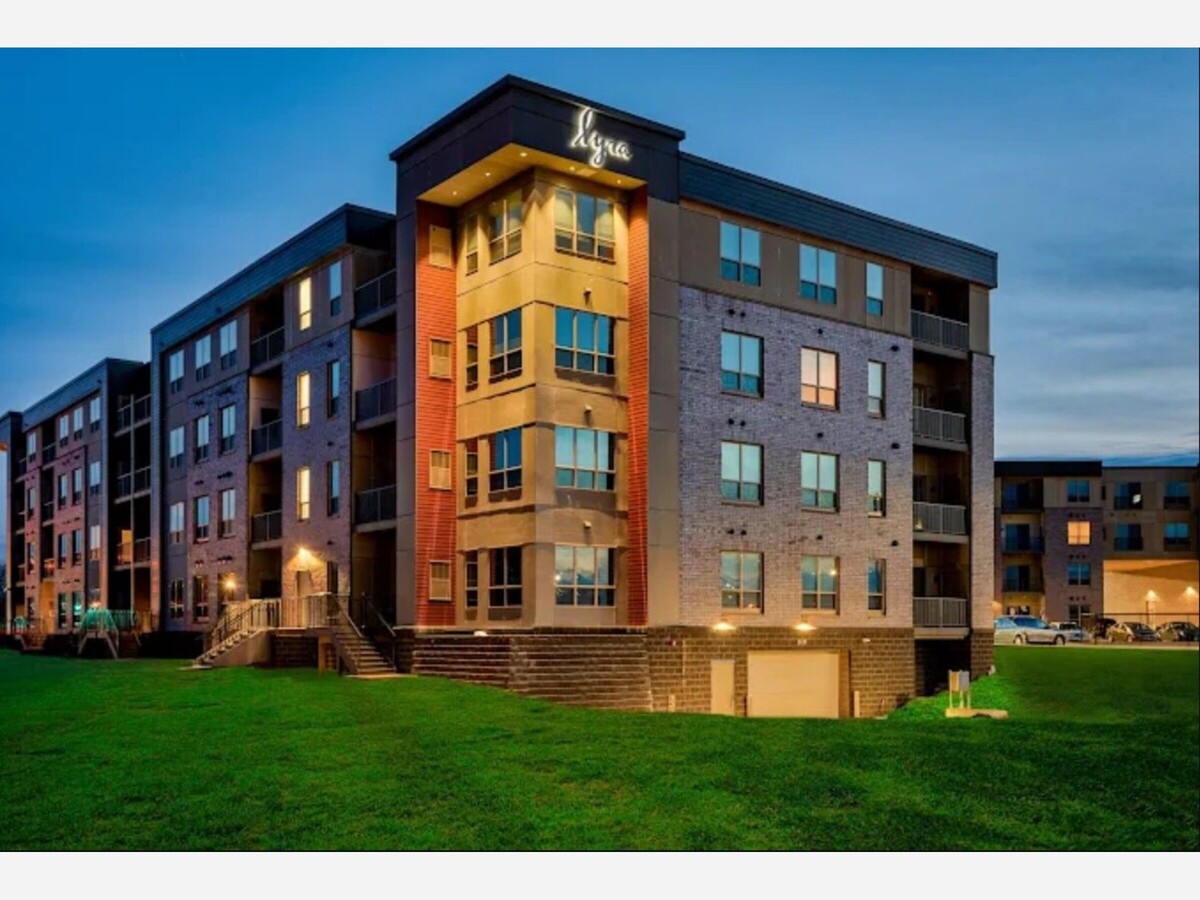

In early February 2026, Lyra at Riverdale Station, a 180 unit luxury apartment community in Coon Rapids, changed hands in a transaction that underscores the growing institutional appetite for transit-adjacent housing in the Twin Cities’ northern suburbs.

The buyer, MLG Capital, acquired the property from Sherman Associates, the Minneapolis based developer that completed the project in 2020. JLL Capital Markets represented the seller and procured the buyer.

The sale price was not publicly disclosed at the time of reporting. Financing for the acquisition was structured through the assumption of an existing HUD loan that had been arranged and is serviced by JLL, according to industry reports.

Located at 3120 Northdale Boulevard NW, Lyra sits adjacent to the Riverdale Transit Station, which serves the Northstar Commuter Rail corridor. The development was conceived as part of the broader Riverdale Station master plan, an effort to create a walkable, mixed use district near retail, employment centers, and regional highway connections including U.S. Highway 10 and Highway 169.

When Sherman Associates opened Lyra in 2020, it marked the first market rate apartment community built in Coon Rapids in more than a decade. At the time of completion, the project carried an estimated development value of approximately 41 million dollars.

The building spans four stories and includes 180 market rate units with smart home features, in unit laundry, granite countertops, and stainless steel appliances. Community amenities include an outdoor pool, a golf simulator, a fitness center, clubroom spaces, and a private dog park.

The Lyra transaction follows MLG Capital’s December 2025 acquisition of The Aster, a neighboring apartment community within the same Riverdale Station corridor. Together, the two trades represent the turnover of the dual-asset core of the master development.

By consolidating ownership of both Lyra and Aster, MLG Capital becomes one of the most prominent multifamily stakeholders in the Riverdale district. In practical terms, that consolidation can influence capital improvement strategies, leasing approaches, and long term positioning of the corridor’s housing stock.

According to JLL brokers involved in the transaction, Lyra was operating at stabilized occupancy levels at the time of sale, with vacancy generally in line with broader Twin Cities multifamily averages, which have hovered near five percent in recent reporting.

Industry analysts note that despite higher interest rates and tighter capital markets nationally, the Minneapolis St. Paul region continues to attract investor interest due to steady population growth, diversified employment sectors, and historically stable rent performance. North metro submarkets such as Coon Rapids, once considered secondary to core urban neighborhoods, are increasingly viewed as durable long term holds, particularly when tied to transit infrastructure.

For Coon Rapids, the Lyra sale is more than a routine real estate transaction. It is a milestone in the city’s ongoing effort to reshape Riverdale from a retail dominated corridor into a mixed use district anchored by residential density and transit access.

Six years after its debut, Lyra’s transfer from developer to long term investor marks the maturation of that vision. The building that once symbolized a new chapter in Coon Rapids housing policy now serves as evidence that institutional capital believes in its staying power.

In a market where multifamily construction has cooled in some urban cores, the north metro’s stabilized assets continue to trade. Lyra’s sale suggests that even in a cautious capital environment, well located, transit oriented housing in suburban communities remains a compelling bet.